Strong first-quarter home sales in the greater Austin area continued into April, according to the most recent Central Texas Housing Report released by the Austin Board of REALTORS®. However, the Austin-Round Rock MSA’s first quarter home sales were tempered with a stalled median home price increase of just .2% during that period. This figure is significantly lower than in the same period in previous years.

“Between 2012 and 2015, we saw price increases as high as 9%,” said Kevin P. Scanlan, 2019 president of the Austin Board of REALTORS®. “These narrower margins are a strong indication that market prices are starting to stabilize.”

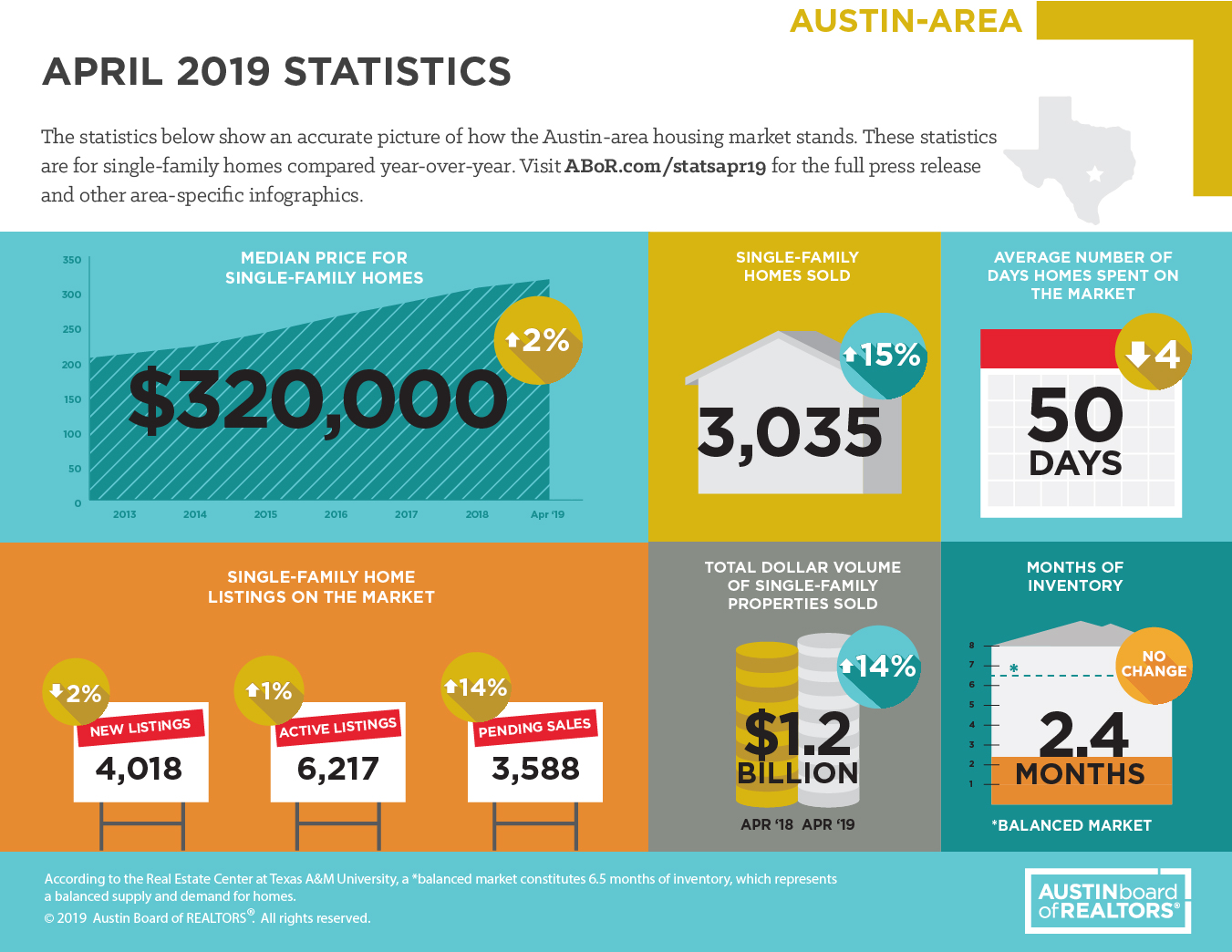

Home sales volume continues to rise in the greater Austin area, and it was up 14.9% to 3,035 sales. Surprisingly, new listings were down 1.8%, but active listings increased 1%, another opportunity for Austin-area real estate investors.

Pending home sales in the greater Austin area spiked to 14.3%, while months of inventory hovered at 2.4.

According to the Texas A&M Real Estate Center, a “balanced real estate market” is defined as six months worth of home inventory. With housing supply hovering at 2.4 months, the greater Austin area remains a “seller’s market,” meaning that it is generally more favorable to sellers/owners due to a reduced supply of homes.

However, with the median home price tapering, there appears to be some stabilization and a silver lining for investors who are considering investing in Austin-area residential real estate, especially while interest rates remain low.

Regardless of your situation, TALK Property Management is always here to help, even if you just have a question about the real estate investments in the Austin area. Or, if you’re considering selling your investment property or if you know someone who is, contact our TALK Property Management today. We are always here to help.