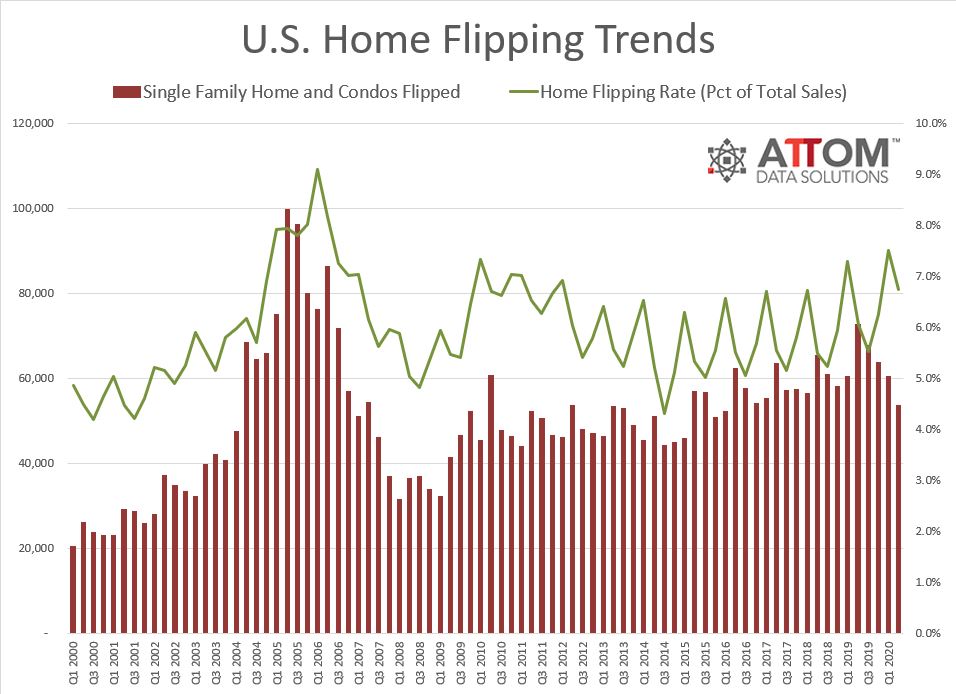

While fewer property investors are flipping homes, those still active in the real estate market are earning higher profits. According to ATTOM Data Solutions 2020 U.S. Home Flipping Report, investment returns for house flippers climbed to the highest level since late 2018.

The typical home flip gross profit (defined as the difference between the median sales price and the median sales price paid by investors) rose to $67,902 in 2020’s second quarter, up from $61,900 at the same time in 2019. This resulted in higher profits for property investors. The typical gross flipping profit ($67,902) equaled a 41.3% return on investment (ROI), marking the first year-over-year gain since the fourth quarter of 2017.

While profits are on the rise, real estate investors engaging in home flipping has dropped since the COVID-19 pandemic began. Fewer house hunters were looking for homes, which likely cut into investors’ likely buyer pool.

However, investors who were able to bring deals to the closing table did far better than they had since 2018, likely due to historically-low interest rates that proved attractive to buyers who remained employed during the pandemic and who were willing to purchase homes despite social distancing requirements and the overall economic environment.

Homes flipped in 2020’s second quarter were sold for a median price of $232,402, while approximately 6.7% of all home sales were flips during the same period, down from 7.5% from the first quarter.

Whether you buy and hold properties or if you prefer to flip, if you have questions about the local real estate market and how it impacts investors, reach out to me anytime. I’m always here to help: (512) 721-1094 or dbrown@talkpropertymanagement.com.

Graph courtesy of ATTOM Data Solutions.